Over a particular winter in the 1630s, everyone in Holland got into the tulip business. People made lots of money on tulips, prices grew exponentially, and at some point, everybody snapped out of it and realized that it was just a flower. Cue economic collapse.

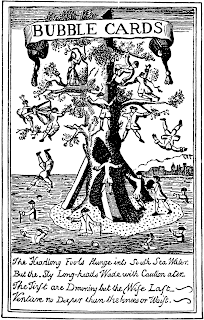

But life went on. In the 1720s, everyone went gaga over getting a piece of the South Sea Company, a British joint stock company that had near-exclusive rights to all sorts of commerce in Spanish South America. Everyone bought South Sea stock, the price went up, and at some point everyone realized it was grossly overvalued, and everything fell in on itself. In response, parliament passed the "Bubble Act" coining a term we know all too well, mostly because passing a law didn't do much good.

But life went on. In the 1720s, everyone went gaga over getting a piece of the South Sea Company, a British joint stock company that had near-exclusive rights to all sorts of commerce in Spanish South America. Everyone bought South Sea stock, the price went up, and at some point everyone realized it was grossly overvalued, and everything fell in on itself. In response, parliament passed the "Bubble Act" coining a term we know all too well, mostly because passing a law didn't do much good. During the recent Great Recession, the same thing happened, with houses this time. But houses aren't tulips, or shares. People live in them.

During the recent Great Recession, the same thing happened, with houses this time. But houses aren't tulips, or shares. People live in them. Of course, houses are only part of the problem. There's finance and corporate profit too.

Of course, houses are only part of the problem. There's finance and corporate profit too. So here we are. Why is this different? Why can't we get over it like the tulip people did, or the shareholders, or the dot-commers for that matter? For my money, the answer is in the little guy. People depended on their houses for money, so much so that they weren't even making more at their jobs, even in good times when they could shop around for wages. Now they have no house and no job.

So here we are. Why is this different? Why can't we get over it like the tulip people did, or the shareholders, or the dot-commers for that matter? For my money, the answer is in the little guy. People depended on their houses for money, so much so that they weren't even making more at their jobs, even in good times when they could shop around for wages. Now they have no house and no job.In a perfectly just world, bankers would have gotten equally screwed in the deal, but letting nature take its course would have been disastrous. Banks were literally talking about shutting the ATMs down in a matter of hours without some sort of guarantee from the government. That's a taste of what was at stake. For better or for worse, the banking sector is fine now. We made them whole. They're back to making money trading abstract things like repackaged debt, just like before, but with a few new rules to stop it from happening again quite the same way.

Banks got a massive bailout and a new law that defines the rules of the games they play in less uncertain terms than before. They may not like being told what to do by regulators, but they have one thing you and I don't. Certainty. The rules are known. The full faith and credit of the Federal Reserve is guaranteed as before, and they can go back to playing, just with more capital padding their leveraged investments than before.

But things are still not well. When people don't have a job, or a home, they're not going to spend money. When people don't spend money, nobody else gets paid. When nobody is getting paid, that means that people don't have a job, or a home, etc., etc., etc...

We tried the classic solution to this problem, stimulus spending. The theory is straightforward. When demand for stuff is weak, the government can step in to give people jobs so they'll spend money, which will give other people jobs, etc., etc., etc... It's generally thought to be ok to go into debt if you have to in order to do this. It'll come back in economic growth, and if you don't spend the money, the whole economy will spiral down the toilet of deflation. That's the theory, and it sort of works. I even think it sort of worked this time.

So what's the problem? Speculation happened, a bubble grew and popped, the government stepped in and did what the textbooks say they should, but everything is still anemic. Money is out there. Banks and corporations are sitting on billions. But businesses are still finding new ways to do more with less, instead of investing in new people, new capital, or new products. The American workforce is 30 percent more productive than Europe's. The dollar is still the preferred currency because our long-term prospects for growth are still better than almost anywhere else in the industrialized world. But people with real skills are looking for work and not finding any. Creative entrepreneurs, people with ideas and a work ethic to match are still just trying to scrape by. Small firms are 99 percent of all corporations in America, employing half the American workforce. This matters.

The answer for the little guy is the same as it is for the banks. Certainty. Small business owners don't know what their new liabilities are going to be when health reform rolls out. Some aspects of the law will help, like tax credits and subsidies for plans. Small businesses will no longer be at a disadvantage to a large company when it comes to benefits. Some aspects of the law will cause new headaches, like reporting more and more information to the IRS. People ready to invest money in a business don't know what they'll owe in taxes next year. They fell like all bets are off under a Democratic administration. Even if the answers to these questions are out there, the people who need them haven't heard. At very least, this is a major failure of communication.

If there is one thing the Obama administration should do that they haven't, it's this: A covenant with the small business owner, writ large. A ten-point guarantee of what the government can offer in terms of certainty. A national TV oval office pledge to veto any legislation that would violate this trust. Here are 10 points I'd like to see:

1. A pledge to leave taxes where they are under a certain payroll threshold, say $1 million.

2. A pledge to leave taxes where they are under a certain income threshold, say $250 thousand.

3. Set a little money aside for small business loans with very generous terms.

4. Set a little money aside for small business grants, issued competitively with business plans.

5. An insurance arrangement that covers against losses for businesses in the program who meet certain terms.

6. An insurance arrangement to mitigate the risk for investors who are interested in bankrolling small businesses.

7. A privately operated program for business owners to go into group purchasing arrangements with other businesses to leverage their buying power for capital investments.

8. A clear, simple statement of small businesses' stake in health reform, both how it helps, and what's expected of them.

9. Assistance accessing foreign markets, and tariff reductions.

10. A domestic and international marketing blitz for American small business.

Providing certainty and support to this area of the economy is what has been missing this whole time. The costs of this package pale in comparison to any stimulus, any bailout, and combine the dynamism of the private market with the security that comes with a government guarantee. America's comparative advantages have always been in our inventiveness and optimism. Economic policy should do everything it can to maximize those advantages. Presidents should do everything they can to push us forward despite everything else.

Nothing happens while people are scared. No one can be optimistic about the prospects of taking a big risk in these times. This administration and our president have let us down in this regard. Policy isn't enough. Certainty is an emotional commodity, albeit one that happens with a good insurance policy, a good loan, some good rules and a good message. It's more than sentimentality. It lets people take risks. Help us feel good about America again. Give us what we need to help ourselves.